University Degrees of Pain

Almost weekly we learn more about the impact of Covid-19 and the corresponding impact of the loss of international student revenues on our universities. They are no doubt all in pain, but quite clearly there are different degrees of pain.

Having personally worked with and supported around eight Australian universities throughout 2020 my assessment would be that a small number are in moderate pain, the majority are in severe pain, and the balance with the greatest exposure to international students are in very severe pain. None have managed to escape pain, nor have any in my humble opinion only got mild pain symptoms.

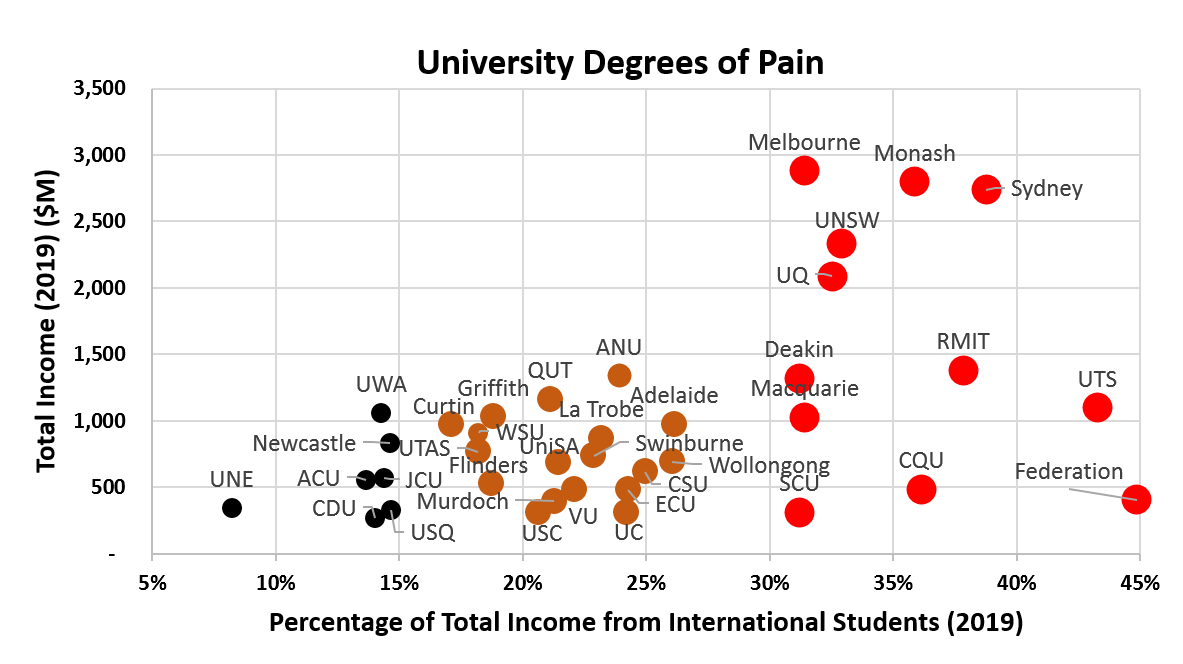

By charting universities on the basis of Scale (Total Income in 2019 (Y-axis)) and their Exposure (Percentage of Total Income from International Student Fees in 2019 (X-axis)), Australian universities fall into three broad categories:

Greater than 31% of 2019 income from international student fees (Very Severe Pain);

Between 15% and 30% of 2019 income from international student fees (Severe Pain); and

Less than 15% of 2019 income from international student fees (Moderate Pain).

Those in Very Sever Pain

Twelve universities fall into the first category (31%+) and are likely to be suffering a world of pain. This group has three scale-based tiers comprising: i) the five largest of the Group of Eight (Melbourne, Monash, Sydney, UNSW and UQ); ii) four $1B+ universities (RMIT, Deakin, UTS and Macquarie) and; iii) three regional universities (Central Queensland, Federation and Southern Cross).

The financial impact - what we know so far:

The University of New South Wales (33% of income from international student fees) reportedly expects a 2021 shortfall of approximately $370m and is looking to address this with a combination of: 237 FTE of voluntary redundancies ($36m); 256 FTE of further redundancies ($39m); $180m in general savings; and $115m from reserves.

The University of Melbourne (31%) has a reported 2020 shortfall of $350m and up to $1B over three years.

Monash University (36%) has a reported $350m shortfall in 2020.

The University of Queensland (33%) has a reported $240m impact in 2020.

The University of Sydney (39%) is said to be only $200m down in 2020 despite carrying the greatest percentage of international student fees (39%) among the Go8 in 2019.

University of Technology Sydney (43%) carried the second highest percentage of internationals in 2019 and is said to expect to lose up to $60m in revenues in 2020 with predicted losses of between $80m and $250m in 2021.

RMIT University (38%) forecasts a potential $175m revenue gap in 2020 and reportedly estimates revenue being down roughly $300m or 22 per cent over the next two years should borders remain largely closed.

Deakin University's (31%) operating revenue is estimated to fall by between $250m and $300m in 2021.

Macquarie University (31%) is reported to be expecting the impact to be between $320m to $410m over the three years 2020 - 2022.

The smaller universities in this very severe pain category include:

Central Queensland University (36%) is reportedly facing a $116m shortfall in revenue for 2020;

Southern Cross University (31%) has a reported $30m impact in 2020 - almost 10% of total 2019 revenue; and

Federation University (45%) had the highest percentage of international student fee income of all Australian universities in 2019 and has been relatively quiet on the forecast Covid-19 impact with new Vice-Chancellor Professor Duncan Bentley only commencing in the role in August 2020.

Those in Severe Pain

The second category (15% to 30%) consists of 18 universities 11 of which sit in the middle range of 20% to 25% (ANU, QUT, La Trobe, Swinburne, UniSA, Charles Sturt, Edith Cowan, Victoria, Sunshine Coast and Canberra). Adelaide and Wollongong are just outside this group at 26%, while Griffith, Curtin, Western Sydney, UTAS and Flinders are just below in a small cluster between 17% and 19%.

The University of Wollongong (26%) has reported a budget shortfall of approximately $90m for 2020.

The University of Adelaide (26%) has reportedly facing a $100m budget shortfall in 2020.

Charles Sturt University (25%) is facing a reported $80m decline in 2020 revenue.

The Australian National University (24%) (based on 2018 numbers only as its 2019 Annual Report is yet to be published) has reportedly said it was working to save $103m each year until 2023.

Edith Cowan University (24%) has not reported financial impact forecasts, however Marshman and Larkins estimated this to be around $40m for 2020.

The University of Canberra (24%) will reportedly lose $33m in revenue in 2020 rising to about $60m in 2021.

La Trobe University (23%) reported in July that 7% of staff from across the University had opted for a Voluntary Redundancy or Pre-Retirement Program (no financial impact forecasts appear to have been publicly reported).

Swinburne University (23%) reportedly faces a $51m deficit this year, followed by the same in 2021 and 2022.

Victoria University (22%) has reportedly forecast $70m of lost revenue over the 2020-2021 two-year period.

The University of South Australia (21%) has not appeared to have publicly reported the financial impact of Covid-19.

Murdoch University (21%) reportedly said in May that "COVID-19 has had a considerable impact on our finances due to several factors, however we will not know the overall impact for some time." Marshman and Larkins estimated this to be around $40m for 2020.

QUT (21%) is the second biggest university by total revenue in this bracket and has plans to address a $100m shortfall in 2020.

Griffith University's (19%) Council reported to staff that the financial implications of COVID-19 to the University would be in the range of $100m - $200m for the 2020 calendar year.

Flinders University (19%) put initial estimates of a potential revenue shortfall in 2020 of around $75m, but later revised this to a shortfall of circa $54m.

Western Sydney University (18%) reportedly faces a $75m shortfall in 2020.

The University of Tasmania (18%) has reported that it faces revenue losses in 2020 of $30m-$34m, and between $60m and $120m per year across 2021-2022.

Curtin University (17%) reportedly expects to be $60m down in 2020.

Those in Moderate Pain

The last category of universities with 15% or less of their income from international student fees in 2019 include a group of six with 14% to 15% (UWA, Newcastle, JCU, USQ, CDU and ACU) and UNE on its own at 8%:

The University of Western Australia (14%) reportedly expects to lose $64m in revenues in 2020.

Newcastle University (15%) has forecast a $58m reduction in revenue for 2020, with $35m in savings needed to be found in 2021.

James Cook University (14%) does not appear to have reported a financial impact forecast.

The University of Southern Queensland (15%) does not appear to have reported a financial impact forecast, although Marshman and Larkins estimated this to be around $18m for 2020.

Charles Darwin University (14%) is reportedly expected to have a deficit of more than $20m as a result of Covid-19 pandemic.

The Australian Catholic University (14%) has reported a forecast revenue loss of $126m over the 2020–22 period due to COVID-19 and the loss of international education revenue.

The University of New England (8%) is reportedly facing revenue losses of $25m in 2020 and similar amounts in 2021.

In Conclusion

Our universities are in a world of pain to different degrees. Few have the reserves and financing ability to ride through the storm without major structural and operational change. All have dramatically cut their discretionary spend and the vast majority have considerable headcount reduction programs and/or negotiated EBA amendments to conditions in a variety of forms.

Throughout 2020 our team has continued to work with and support academics and professional staff at more than a dozen universities in pursuit of major new revenue sources and industry connections. During this year like no other our university-clients have all demonstrated four common traits - resilience, flexibility, passion and unwavering optimism!

Key Questions

What does this mean for Australia's research? Will the Federal Budget deliver any substantive relief? What can we expect from the Joint Research Working Group? How must our universities transform for the future? What are the lessons from how they pivoted this year? How should they reorganise themselves for the future? How can they reshape their finances? How can they truly engage with industry?

Mike Pepperell is Managing Consultant at CIS and has advised more than a dozen universities over much of the past decade.

The broader CIS team has advised around 30 universities and a number of major Research Institutes over the past 20 years, helping to raise more than $1B in research and infrastructure funding in the course of their strategy and implementation consulting engagements (and more than $4B when partner cash and in-kind contributions are included).

Industry engagement is a particular sweet spot, with over a decade of CRC-related consulting activity - including support the four successful Round 20 CRC bids and four of the five successful Round 21 bids (securing a total of $342M in Commonwealth Government CRC Program funding)!